Apple Computer founders and Partnership

Apple Computer turned 40 years old today. No April Fool’s joke here – Apple was started on April 1, 1976. The Apple Computer founders formed a Partnership, which has a crucial lesson for every startup and entrepreneur. To honor a company whose products I love, and have used for almost all of those 40 years, and for all the startups and entrepreneurs, this is about an aspect of its founding.

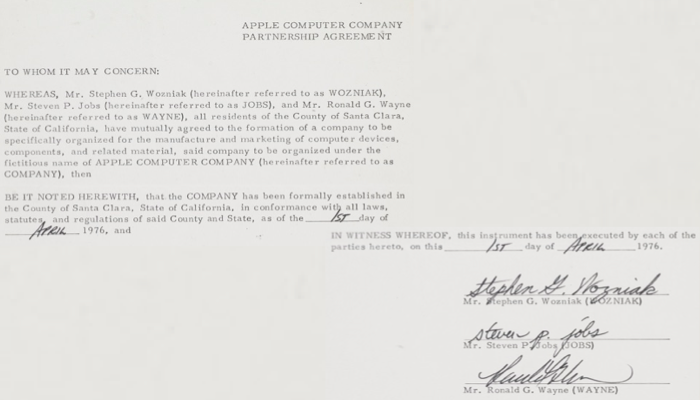

Apple Computer Founders started with a Partnership

The three Apple Computer founders were Steve Wozniak, Steve Jobs, and Ron Wayne (you can read more about the story here). Mr. Wayne withdrew from the partnership after just 12 days. From interviews that Ron Wayne has given, one of his reasons for withdrawing from the partnership was that he didn’t want to be personally liable for all of the $15,000 debt that the new partnership was taking on in order to fill its first order for 50 computers. He was bought out for $800! And later, another $1,500.

He was right

Mr. Wayne was right. He was personally liable for the new partnership’s debts, as partners are in a partnership: Steve Wozniak and Steve Jobs would have been too, but Mr. Wayne reasoned that they didn’t have money and he did.

But he was also wrong

Mr. Wayne was wrong not in his assessment of his personal liability for the new partnership’s debt. But he was wrong to found the company as a Partnership – according to this article, Mr. Wayne typed out the Partnership Agreement from memory. While a Partnership is easier to start than a company, and easier to maintain, it is rarely a better choice, for several reasons. One of those is the issue of personal liability for the entity’s debts or liabilities, which Mr. Wayne correctly foresaw.

The Lessons

Form a company

Form an entity for your company, preferably with the advice of an attorney experienced in helping founders. While Mr. Wayne doesn’t dwell on what could have been, it’s easy for everyone else to wonder “what if” with regard to the 10% stake he could have kept, in a company now valued at roughly $600 billion. And if they had hired an attorney to help them form a corporation, maybe Mr. Wayne wouldn’t have felt compelled to withdraw from the company over the issue of liability for its debts.

Keep some equity

If you found a company and must withdraw, consider keeping just a little equity. Because you never know. For Mr. Wayne and the better-known Apple Computer founders, every bit of Apple Computer history is valuable. Take a look at Mr. Wayne’s original signed Partnership Agreement: he sold it in the mid-1990s for $500. Mr. Wayne says that sale is his one regret regarding Apple, and understandably: that bit of history was sold by Sotheby’s in 2011 for $1.6 million. You can see the Apple Computer founders Partnership Agreement here.

Do you have questions? Agree or disagree? I’d be glad to hear from you in the comments. Call me at 617-340-9295 or email me at my Contact Me page. Or, find me on Facebook, Twitter, Google+, LinkedIn, Google Local, or Avvo.

[…] If you plan to make or sell products, or offer a service, it almost always makes sense to form a company. Having a company will make it easier to use your patent to help generate a revenue stream. And having a company can give you protection from personal liability, provided you follow corporate rules and manage the company properly. If you don’t have a company, you should assess whether it makes business sense for you to form one, and you should consult an attorney about your business plans. And for a cautionary tale on forming a partnership, rather than a company, have a look at my post on the Apple Computer founders and partnerships. […]